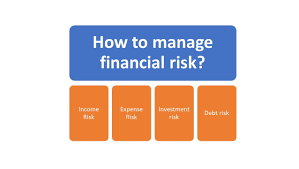

Summary: Financial risk is the possibility of losing money due to changes in the financial markets. It can be caused by a variety of factors, such as changes in interest rates, stock prices, or exchange rates. Financial risk can have a significant impact on businesses and individuals, and it is important to understand how to manage it.

Body:

There are many different types of financial risk, including:

Market risk: Market risk is the risk that the value of an asset will decline due to changes in the market. For example, the value of a stock can decline if the overall stock market declines.

Interest rate risk: Interest rate risk is the risk that the value of an asset will decline due to changes in interest rates. For example, the value of a bond can decline if interest rates rise.

Currency risk: Currency risk is the risk that the value of an asset will decline due to changes in exchange rates. For example, the value of a foreign currency-denominated asset can decline if the exchange rate between the two currencies changes.

Liquidity risk: Liquidity risk is the risk that an asset cannot be easily sold without causing a significant decline in its value. For example, it may be difficult to sell a large number of shares of a stock without causing the price of the stock to decline.

Credit risk: Credit risk is the risk that a borrower will default on a loan. For example, a bank that lends money to a company may lose money if the company defaults on the loan.

Financial risk can have a significant impact on businesses and individuals. Businesses can lose money if their assets decline in value, and individuals can lose money if their investments decline in value. Financial risk can also lead to job losses and economic hardship.

There are a number of ways to manage financial risk, including:

- Diversification: Diversification is the process of investing in a variety of assets. This can help to reduce risk by spreading it out over a number of different assets.

- Hedging: Hedging is the process of taking steps to reduce risk. For example, a company that exports goods may hedge against currency risk by buying forward contracts.

- Insurance: Insurance can help to protect against financial losses. For example, a business may buy insurance to protect itself against the risk of fire or theft.

By understanding financial risk and taking steps to manage it, businesses and individuals can reduce the likelihood of financial losses.

Conclusion:

Financial risk is a fact of life, but it can be managed. By understanding the different types of financial risk and taking steps to mitigate them, businesses and individuals can protect themselves from financial losses.

Comments